One of our favorite writers and observers of the human condition was John Perry Barlow. Here is his missive, “The Pursuit of Emptiness” originally published in Forbes:

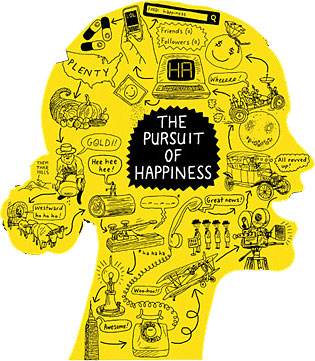

The Pursuit of Emptiness: Why Americans Have Never Been A Happy Bunch

Forbes ASAP, 12.03.01

Happiness is the absence of striving for happiness.

-Chuang-tzu (369-286 B.C.)

Extolling the pursuit of happiness was a toxic stupidity entirely unworthy of my greatest American hero, Thomas Jefferson. Indeed, the pursuit is a poison that sickens our culture. I wish he’d never said it.

It produces a monstrous, insatiable hunger inside our national psyche that encourages us to ravenously devour the resources of this small planet, crushing liberties, snuffing lives, feeling ourselves ordained by God and Jefferson to do whatever is necessary to make us happy.

During the year 2000, while feeding at the greatest economic pig trough the world has ever slopped forth, Americans ate $10.2 billion worth of Prozac and other antidepressants (up 19.5% from the previous year). Better living through chemistry? I don’t think so. I have never heard any of my friends and acquaintances who have become citizens of the Prozac Nation claim that these drugs bring them any closer to actual happiness. Rather, they murmur with listless gratitude that antidepressants have pulled them back from the Abyss. They are not pursuing happiness; they are fleeing suicide.

Not until I turned 30 did it become apparent that my wariness of the pursuit of happiness might be a subtle form of treason. Like many of my generation, I hadn’t expected to live to such an age. I really didn’t trust anyone over 30, and remain reluctant to do so even now. But since I was about to become an adult, I figured I ought to take a stab at graceful adulthood.

So I spent the night before my 30th birthday composing a list called “Principles of Adult Behavior.” Most of my self-directed advice consisted of such platitudes as Polonius liked to lay on Hamlet–stuff like “Expand your sense of the possible” and “Tolerate ambiguity.”

But there was a patch in the middle of this earnest document that nearly every American who read it bottomed out on. And that was No. 15, which stated: “Avoid the pursuit of happiness. Seek to define your mission and pursue that.”

Despite the safely Puritan kicker, this homily pissed off the broadest range of folks you can imagine. Whether hippie, cowboy, redneck, or debutante, practically everyone who read it thought there was something threateningly wrong with it. It was downright un-American. Why?

Because nearly everyone in this country feels the weird, invisible pressure to pursue happiness; they feel that secret shame of not trying hard enough to attain it. To have someone tell them they should just stop trying felt like a threat to an oath they’d taken. In other words, Jefferson’s wistful aspiration has gradually transmuted into first an entitlement and eventually an obligation, even as its actual practice has become increasingly rare. Listen carefully for the sound of spontaneous laughter in America’s public places. Observe random American faces for the sight of a smile. You will be alarmed, I think, at how infrequently we are illuminated by such natural human light. And yet, behind these grim masks, there continues to reside the guilty belief that happiness is ordained by Jefferson (and possibly God) to be our duty.

Ask an American how he’s doing, even in these times of pandemic chaos and fear, and he will instinctively reply, “Fine.”

Yeah, right.

Let me be clear. I like happiness. Hell, I think I am happy most of the time. And why, when I’m happy, am I happy? Never because I pursued happiness but rather because I let it pursue me. To me, the more you ignore happiness, the more it will come looking. Swami Satchidananda of India put it better: “If you run after things, nothing will come to you. Let things run after you. The sea never sends an invitation to the rivers. That’s why they run to the sea. The sea is content. It doesn’t want anything. That’s the secret in life.”

In Africa, the Zulu have a word, ubunto, which is often translated to mean community, but I’ve heard a more accurate definition: “I am because we are; we are because I am.” In other words, happiness is not a solitary endeavor; it’s a joint enterprise, something that can only be created by the whole. I am happy because we are happy. Contentment arises from a sense of family, community, and connectedness.

Such virtues are in dwindling supply in America. Close to half of first marriages end in divorce. The war between children and parents has never been uglier. We ridiculously imagine that America Online and the local mall are communities. And to the extent that we are connected at all, it is largely by mass media like television, which, as Bertrand Russell pointed out, “allows thousands of people to laugh at the same joke and still remain alone.”

Do we Americans lack this sense of connectedness because of our affluence? Does wealth induce loneliness? I don’t think so. But to address the problem, we first have to admit that it exists. This will not be easy. Many of us are convinced that our sorrows are a sign of personal deficiency. Thinking that we are alone in our politically incorrect despair only drives us deeper into personal isolation.

But more to the point, we need to rethink some of the basic assumptions of the industrial economy. Chief among these is the idea that there is a natural division between our lives and our livelihoods. The first thing we learn in school is that it’s supposed to suck. Learning is work, and we fully expect that the work we do in later life will make us equally miserable. We render unto Caesar for eight dreary hours every day, during which we expect not to be ourselves but rather interchangeable machine parts in some great industrial engine.

This doesn’t have to be the case. I was a cattle rancher for 17 years, during which there was no discernable division between my life and my work. It was cold, arduous, and involved constant contact with actual bullshit, but I loved it. Following my realization that ranching had become a lifestyle that only the already wealthy could afford, I turned to thinking for a living. This is also hard, and there is plenty of bullshit involved, but I can only do it as myself. Yet most organizations still require their “knowledge workers” to be as self-alienated as lathe operators. There was a glimmer of hope in the dot-com startups, but these have either failed or become big enough to assume the isolating social practices of their industrial predecessors.

Better still, there has never in history been such an abundance of young people who have already experienced the futility of wealth. They spent a couple of years pursuing IPOs that would “release” them to a lifetime of starlet-chasing on the Riviera. Now many of them are more dedicated to making a difference than to making a dollar.

Which brings me to another solace still available to us. Consider the joys of service. As a few leaders, ranging from Jimmy Carter to the Dalai Lama, demonstrate, we can become happy through the exercise of compassion. But following the training we receive in schools and workplaces, we have come to regard service as a self-suppressing obligation rather than a self-fulfilling responsibility. It doesn’t have to be that way.

Perhaps, in the wake of the September 11 massacre, this is changing. Now, hundreds of thousands have experienced the obscure delight of donating blood. Millions more are finding, in the presence of such loss and terror, what really matters. Love can thrive in the presence of fear. As a society, we are well positioned to both love and accept love.

All this doesn’t mean that happiness can only be found through connectedness. You can find happiness when you are alone. Sometimes I think of something Kafka–that noted happiness-hound–wrote:

It is not necessary that you leave the house. Remain at your table and listen. Do not even listen, only wait. Do not even wait, be wholly still and alone. The world will present itself to you for its unmasking, it can do no other, in ecstasy it will writhe at your feet.

Kafka is not talking about the pursuit of happiness. He’s not even talking, as one might easily and incorrectly conclude, about lying in wait for happiness. He’s talking about making yourself genuinely available to it. Opening yourself to the little things: the sunrises, the lilac-scented breezes, the hilarious bartender jokes, the inside straights, the large purring cats, the click of stiletto heels, the very granular texture of unsolicited joy.

Worry. Be happy. But remember that happiness is a gift you owe yourself. It is not an obligation you owe to Jefferson, the United States, or God Itself.

John Perry Barlow is a retired Wyoming cattle rancher, Grateful Dead lyricist, and cofounder of the Electronic Frontier Foundation. His last essay for Forbes ASAP was “Surfing the Fence Line” in Big Issue II: @ Work.

Source: https://www.eff.org/pages/pursuit-emptiness-why-americans-have-never-been-happy-bunch